In this article:

This article provides solutions for failed transactions and guides you on how to resolve them efficiently and effectively.

Various Causes for Transaction Failure

- A transaction can fail for several reasons.

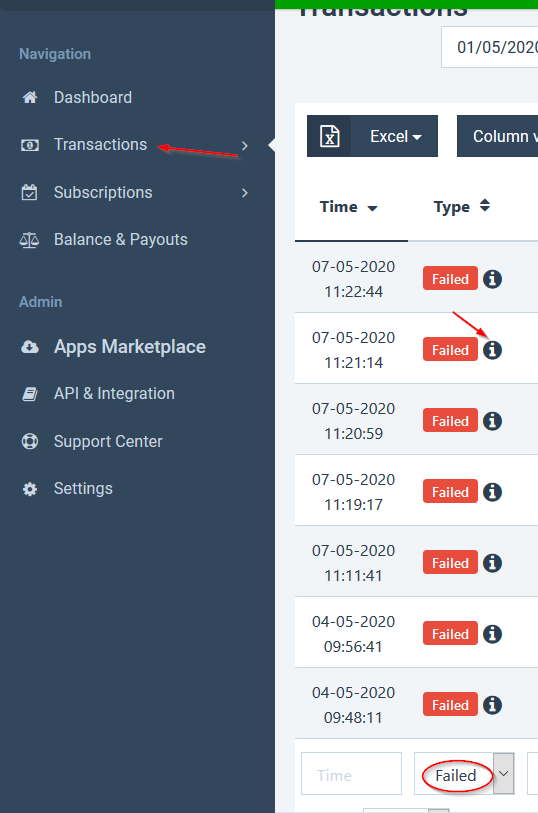

- If a transaction with a "Failed" status appears on your interface, either on the main screen or the transactions screen, you can view the reason for the failure by clicking the "i" button next to the transaction status.

- You can view all failed transactions within a specific date range by selecting the "Failed" status filter. The filtering options are located at the bottom of the transactions page, beneath the search results:

The Main Reasons for Payment Failure:

Below you can find a list with the most common reasons for a failed payment.

252- An error that occurs when a foreign currency billing attempt is made on an account that is not authorized to clear the relevant currency.

253- An error that occurs when an attempt is made to redeem a card issued outside of Israel when this setting is not enabled for the account in question.

To address these errors, you can establish a foreign currency clearing account by contacting PayMe's KYC department via email at KYC@payme.io.

427/428/421/420/424/425/426/422 - Errors in Supplier or Clearing Account Settings:

If one of the above error codes appears, it indicates an error arising when attempting to process a charge that does not align with the service settings of your clearing service provider.

-

Error when attempting to charge a premium-branded credit card:

- For example, it is not possible to process a Diners/Discover branded card through a provider issued by Isracard.

-

Error due to unauthorized currency:

- Occurs when attempting to charge in a currency that is not authorized according to the provider and/or clearing account settings. Additionally, the clearing account settings may not allow the processing of credit cards issued abroad.

-

Error when attempting to process a transaction below the minimum amount:

- This error appears when attempting to process a transaction below the minimum amount set by PayMe, which is 100 ILS/USD/EUR.

Decline by the credit card company:

This error can occur for various reasons where the credit card company that issued the customer’s card declines the transaction, such as insufficient available credit. In such cases, please direct your customer, the cardholder, to contact their credit card company for clarification.

Incorrect CVV or ID number:

This error occurs when incorrect digits are entered for the CVV and/or ID number of the cardholder during the charge attempt. For cards issued abroad (tourist cards), the error will refer to the CVV only.

Connecting to the "Failed Transaction Recovery" Service

This service allows the business to receive an immediate real-time SMS alert for a failed transaction in the clearing account, with all the necessary details to recover the transaction. By using this service, you can prevent transaction failures and potential sales losses, thereby increasing your business's profits.

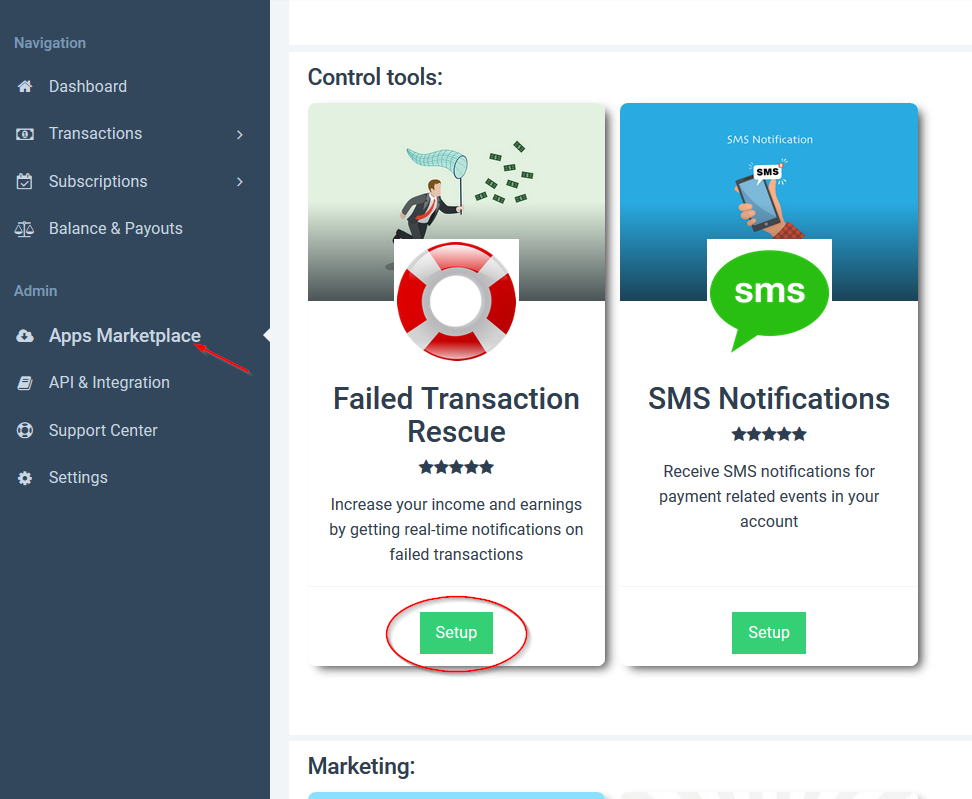

How to connect to the "Failed Transaction Recovery" service?

- Log in to your PayMe account.

- Go to the Apps Marketplace in the navigation bar.

- Click on Control and Monitoring Tools.

- Select the Failed Transaction Rescue service.

- Click on Install.

Click Activate app and agree to the Terms & Conditions.

Now, a green window will pop up on the top right corner confirming that you enrolled successfully.